By Kaitlin Heatwole & Ethan Sleeman | October 5, 2020

The COVID-19 pandemic and the subsequent recession have serious ramifications for North Carolina workers. Recent reports suggest that more than 1.3 million North Carolina residents have filed a combined total of 2.4 million state and federal claims since the pandemic’s onset1. However, those claims are not equally distributed. Trends in the initial unemployment insurance (UI) filings show different experiences across race and gender. Gender disparities were more severe earlier in the pandemic and narrowed over time. Meanwhile, racial disparities were muted earlier on, and became more severe as the pandemic progressed.

Changing unemployment claims during the COVID-19 recession in NC

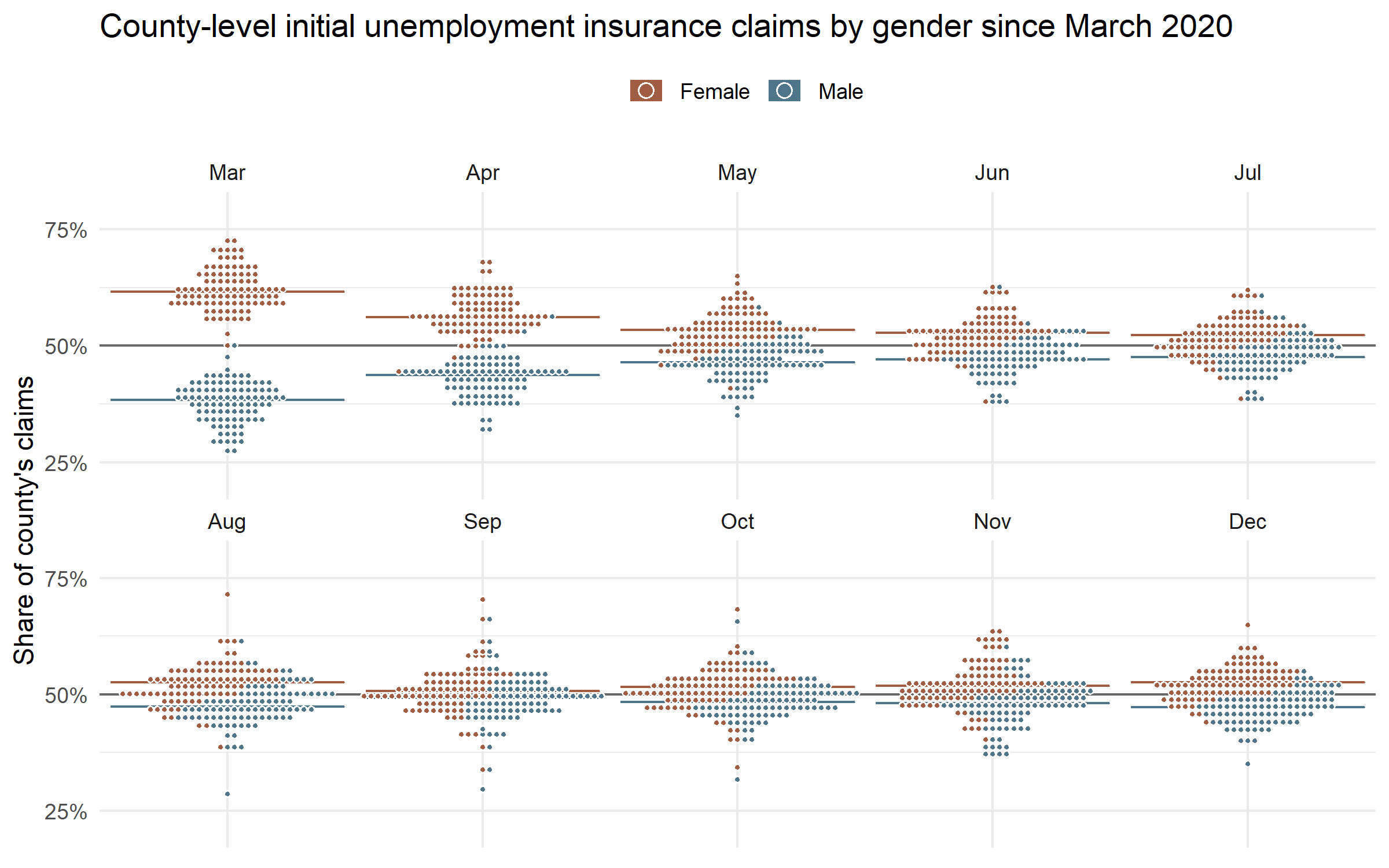

In the first months of the pandemic initial unemployment insurance filings have a marked gender disparity, with women disproportionately filing more claims. A proportional outcome would show filings by women and men clustered on the horizontal axis. This is likely due to the fact that women are more likely to work in professions that require close contact such as retail and personal services, making them less able to shift their work to a remote format, and thus more vulnerable to the initial wave of layoffs at the outset of the pandemic. However, the gap in initial unemployment claims has closed over the course of the summer, and by the fall there is no large disproportionality in UI claims by gender.

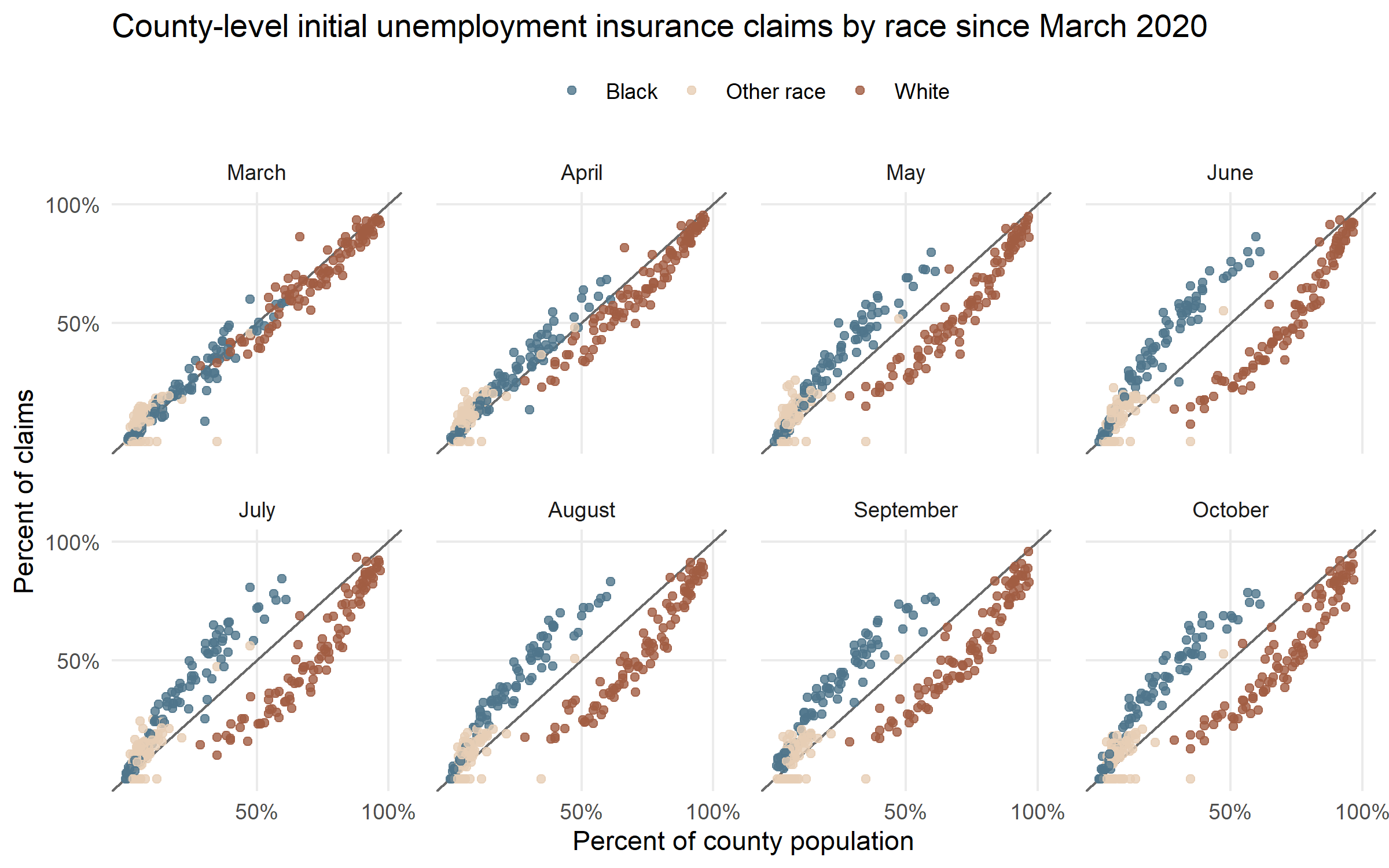

While the gender gap narrowed throughout the pandemic, the racial gap in initial unemployment insurance claims in North Carolina widened. The second chart is a time series that plots two variables relating to unemployment insurance claims. The horizontal variable is each county’s percentage of its total population belonging to a given racial category (Percent of county population). The vertical variable is the percentage of initial unemployment insurance claimants by racial category within a specific county. Each county has three dots, representing the population of a given county’s Black, white, and ‘other race’-classified residents.

The diagonal line represents a proportional distribution between the two variables. If a dot is exactly on the line, it means that the number of unemployment insurance claimants identifying with that racial category are proportional to the percent of county residents identifying with that racial category. Dots above and to the left of the line indicate an over-representation of UI claimants, while those below and to the right are filing UI claims at lower rates. In March, most of the initial unemployment insurance claims fell close to this line. As the pandemic progressed, we see increased divergence by race. Black filers became overrepresented relative to their share of the population, while white filers were underrepresented. Filers of the ‘other race’ category were more modestly overrepresented as the pandemic progressed.

Understanding disparities in unemployment insurance claims

While the disparate impacts of the COVID-19 recession on North Carolina’s workers are clear, the trends by gender and race are not straightforward. At the beginning of the pandemic, women were clearly impacted at greater rates than men, while racial disparities seemed to be less severe. By September 2020, these patterns reversed.

The difference between initial and continued unemployment insurance claims can add some nuance to these patterns, but does not fully explain them. Women still file a disproportionate number of continued unemployment insurance claims (claims meant to extend already-granted unemployment insurance) as the pandemic has progressed. Meanwhile, disparities by race have been more pronounced in initial unemployment insurance filings throughout the pandemic.

There are entrenched inequalities by gender and race in U.S. labor markets that point to areas for further research. As previous data suggests, black workers are more vulnerable to layoffs during recessions than white workers and that is evident in the current pandemic recession. Sociologists have also identified profound challenges faced by women in balancing labor market participation and domestic work. Disruptions to childcare and school closures intensify this dilemma and add extra pressures on working mothers. We need to learn more about how these entrenched patterns are reflected in important institutions such as unemployment insurance, also drawing on other data sources like slowing travel patterns and risks to personal safety to uncover other reinforcing signs of gender and racial disparity.