By Donald Planey | October 22, 2020

Across the United States, office buildings have lost tenants due to the economic slowdown, the pivot to remote working, or both. The business press is reporting resiliency in U.S. warehousing markets, where buildings are retaining their tenants, or even adding new ones. However, commercial real estate is profoundly regional and the unique market dynamics and local conditions influence commercial real estate dynamics. This visualization focuses on North Carolina’s office markets by county.

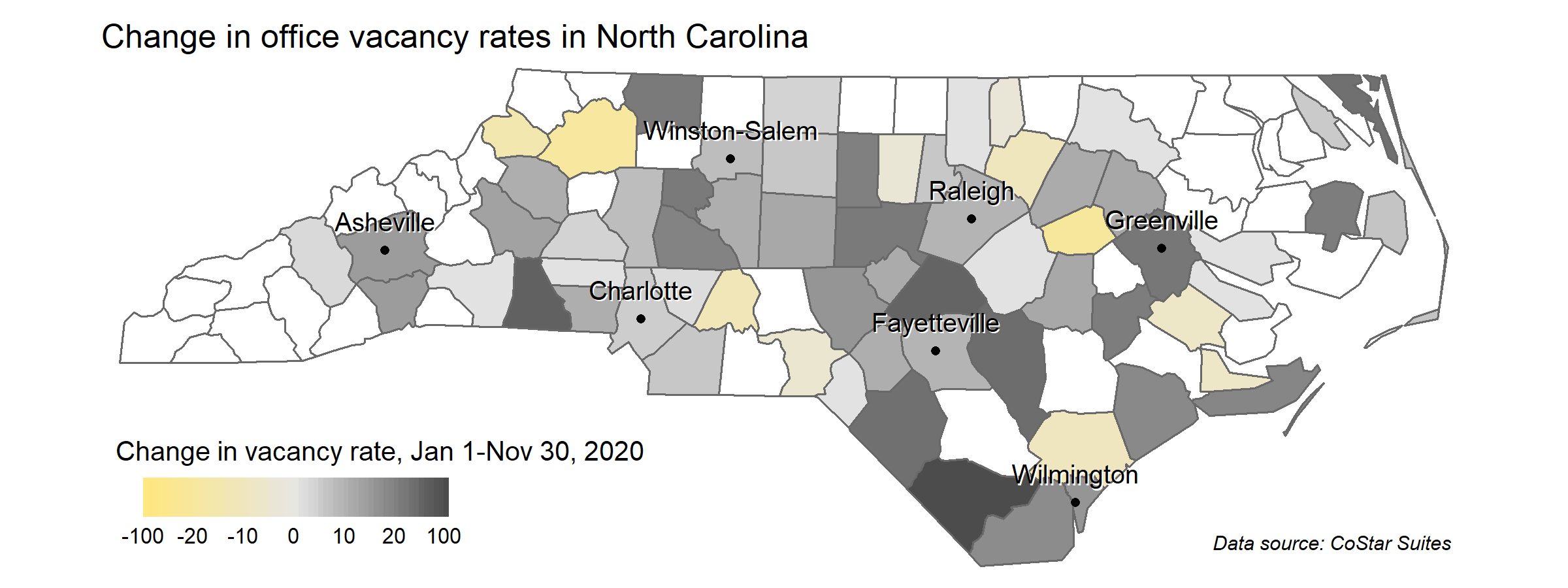

North Carolina is a state of many metros, such as Raleigh, Charlotte, Durham, Greensboro, Asheville, and Winston-Salem. Between the end of 2019 and September 28th, 2020, North Carolina’s vacancy rate for leased office space jumped by 2.9%. But what precisely does this mean? We examine how the COVID-19 economic shock has affected office use across the state’s array of urban, suburban, and rural counties.

Vacancy Rate

A vacancy rate is the percentage of space (usually measured in square footage) of a given real estate market that is unoccupied by a tenant. A 2.9% increase in office vacancy since the start of the pandemic would seem to be attributable to the economic shock caused by COVID-19. But vacancy rates in real estate markets are always fluctuating, and there are multiple reasons a vacancy rate would increase. New building construction can increase a market’s vacancy rate by adding to the total inventory. By itself, the vacancy rate does not tell the entire story.

From a glance at the above map, it is clear that more counties are seeing increases in their vacancy rates than decreases. But many of these counties are rural and have small office space markets. If one tenant leaves or moves into one of these counties, it can single-handedly change the vacancy rate. How do we confirm that the economic impact of the pandemic is influencing the changing vacancy rates we see here?

Absorption

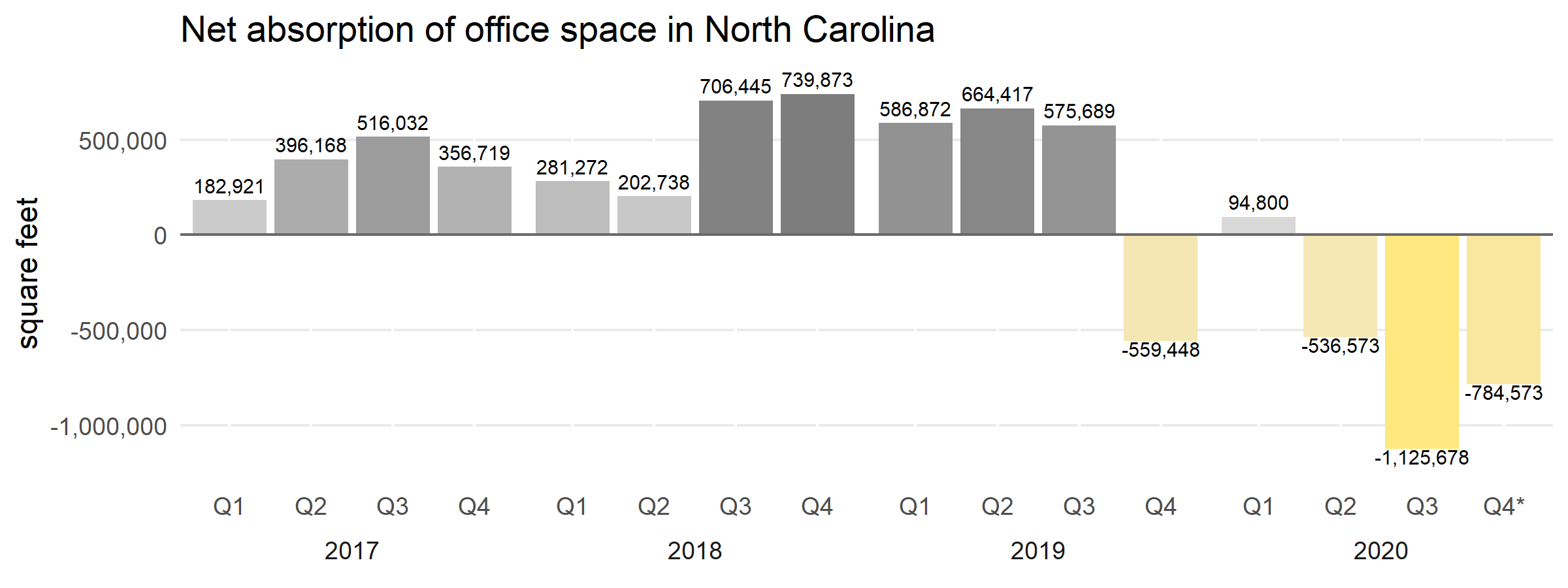

The net absorption of North Carolina’s statewide office market helps to show that the COVID-19 economic shock is, in fact, negatively affecting the state’s office capital stock.

Absorption is a measurement of a commercial real estate (CRE) market’s ability to accept new tenants in a given period of time. If a market absorbs 500,000 square feet of space in a business quarter, it means that new tenants are occupying an additional 500,000 square feet in the market area. The net absorption is new occupied space minus newly vacated space. Since the start of the COVID-19 pandemic, North Carolina’s absorption statistics have trended negative, suggesting serious difficulty in finding and retaining office tenants across the state.

Generally, commercial real estate markets- whether office, warehousing, or light industrial buildings- are concentrated in metropolitan regions. However, most counties in North Carolina have seen increases in office vacancy rates during the pandemic. The COVID-19 recession has had an adverse impact on investment in commercial real estate across the world, with substantial divergence in adaptability and resilience between different regions and markets. In North Carolina, we are seeing this pattern repeat itself across the state’s 100 counties, with some counties suffering from extreme spikes in office vacancy, many suffering from more modest increases, and a handful of counties bucking the trend of rising vacancy rates. While there has been a statewide increase in office vacancies throughout the state, policymakers and researchers should attune themselves to local office market conditions on the ground.