By Ethan Sleeman | November 24, 2020

Residential real estate development and sales have taken on a peculiar pattern during the COVID-19 recession. On the supply side of the market, developers are building fewer residential buildings than before the recession. On the demand side, housing prices have rapidly trended upwards. North Carolinians are selling their houses and moving, but within a supply-constrained market. Below, we unpack the situation, and suggest possible implications.

The supply-side: New permits are down compared to 2019 levels

Before the pandemic, residential building in North Carolina was robust, trending upwards with the overall U.S. economy. However, since March new building permits have dropped dramatically, especially when viewed as Year-over-Year change since 2019. For a brief period in August 2020, there was cause for hope: New permits climbed to just 50 permits fewer than August 2019 levels, before dropping again in September.

This overall slump in new permits suggests a lack of confidence in the housing market, and in particular a lack of confidence about the near-future state of the market on the part of developers. Facing a recession of indeterminate length, and a lack of clarity about when - or if - employment and spending levels will re-stabilize, developers appear to be stepping back from new projects and commitments. This is certainly exacerbated by rising building construction costs, as these costs have contributed to many builders and developers putting the brakes on new development.

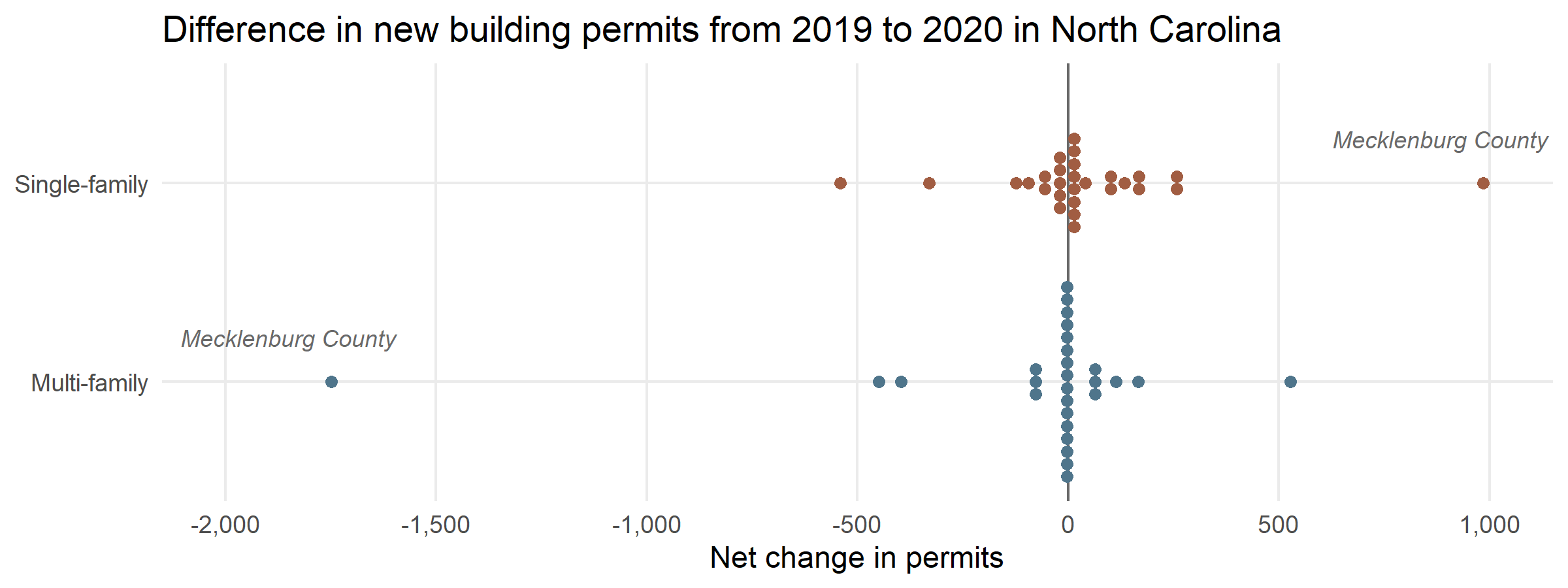

The supply-side: Multi-family vs. single-family permitting

If we compare multi-family (apartments, condominiums, or townhouses) to single-family residential real estate, we can see additional factors at play. Our data on building permits indicates that there is ambivalence about the future for multi-family development: Median change in new permits over last year is 0, meaning that across the state, developers are not taking out more multi-family permits than last year. One interpretation of this data is that developers do not anticipate substantial growth in the market for multi-family units. There does seem to be cautious optimism for growth in demand for single-family homes, with permits for new single-family units up about 4.5 permits over the previous year (per month). However, this number hides some considerable variation in new single-family home starts.

Developers across the state are fairly consistent in their treatment of multi-family permits, with almost all counties clustered around the 0 line (Mecklenburg County being a notable exception, where there has been a significant drop in multi-family permits from 2019). While some counties are seeing slight increases, the data is strongly clustered right around 0. The median change of +4.5 permits/month for single-family permits, though, hides somewhat more variation: many counties are seeing Year Over Year (YOY) changes of +200 permits and more, while others are seeing YOY changes of -100 permits per month. One reading of this data is that developers see specific regional markets as likely to have sustained growth, while others may be viewed as a short-term spike. These data must be considered against a broader context, where rising costs of building materials, and caution from institutional lenders, are likely influencing decisions about starting new building projects. Future research should explore those regional variations to look for local real estate trends within that broader context.

We should note that the multi-family market was potentially going to slow even without the pandemic, as changing demographics and a glut of new properties lead to an already anticipated softening of the market. The COVID-19 recession may be pouring cold water over an already-dampening multi-family market.

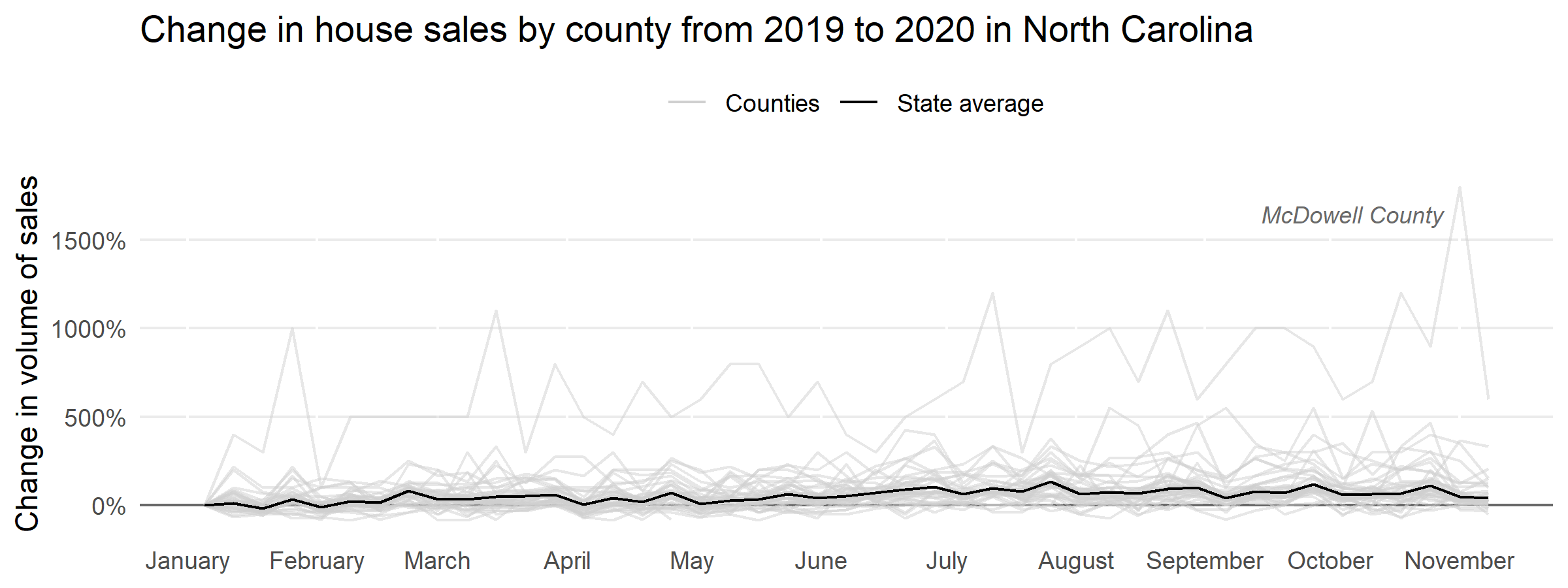

The demand-side: Surge in demand for single-family homes

The demand-side of the market – the selling and buying of homes – has also taken on peculiar trends during the COVID-19 recession. To put it mildly, there is a lot of movement in the single-family home market, with almost every county in the state seeing sales increases of almost 50% over 2019. Some counties are seeing 200%+ changes in home sales over 2019, a trend that many observers are attributing to residential patterns changing from the pandemic. According to NPR, the pandemic, and a corresponding transition to working and schooling from home, is fueling an increasing desire for larger homes. Many households are seeking homes with a dedicated office, a larger yard, space for a home gym, and other amenities.

Demand for larger single-family homes during the pandemic

The demand for ‘upward moves’ has driven up median sale prices, with the statewide median sale price for a single-family home in August 2020 more than 14% above the median sale price in August 2019. In fact, beginning in May, median sale prices have shot upwards compared to 2019, and are now the highest they have been in the previous 8 years. In other words, homes are selling for significantly more money than last year, and sale prices have grown at the highest rate in nearly a decade over the course of the summer. Single-family homes are also selling faster than they have in the past decade. Homes typically sell the fastest in May-June, and then the time on market increases every month until peaking in January, a typical seasonal dynamic for residential real estate markets.

However, this year has been different. While in 2020 we saw slightly longer median time-on-market in peak months than in 2019 (53 days versus 52), those times have since dropped even further as we move into the fall of 2020, to a new ‘low’ of only 48 days on the market. This is the first year in nearly a decade where there is a shorter time-on-market in September than in May, suggesting that the demand for new homes is still strong and distinct from the typical seasonal patterns of demand.

Perhaps one of the strongest indicators of the intensity of demand for single-family housing is that the percentage of homes selling above the list price - that is, people are paying more for the house than the house was offered at - is in September of 2020 the highest it has been since 2012, and is fully 22 percentage points higher than the percentage of homes sold above list price this time last year. In fact, despite the pandemic and the accompanying economic recession, almost every single county in the state is showing a positive (and in most cases >10%) increase in ‘above-list-price’ sales. The magnitude is different county to county, but across North Carolina people are increasingly willing to pay more than asking price for a new house. All these trends point the same direction: the demand for single-family homes is incredibly strong at the moment. More homes are being sold, at higher prices, above asking price, and with shorter turnaround. This holds true not only when 2020 is compared to 2019, but for any time in the past decade1.

Where is housing going in North Carolina?

The dual-trend of declining building permits and a massive demand for housing points to an imminent supply and demand problem. We are already seeing some of the effects of a supply and demand mismatch in the market, with homes increasingly being sold above list with little time on the market. Without a substantial injection of additional supply, those trends will likely continue, as demand bids up the prices of homes into the new year. One big question mark, for developers especially, may be whether the changing preferences for larger homes, and more space, will continue through the pandemic and if they will represent a permanent shift once the pandemic ends.

There are also important questions that researchers and policymakers need to ask. While there seems to be an observable change in preferences for larger single-family homes among those who can afford them, not all North Carolinians can afford a large single-family home. It is also possible that institutional factors may be suppressing multi-family sales or construction, such as risk-induced overcorrection by lenders or developers amidst profound uncertainty about the future. We need to understand which factors - financing, construction, or consumer demand - have influenced supply- and demand- side trends in North Carolina residential real estate markets.